Hands-on finance takes center stage at Fowler

New research challenges, competitions and industry tech are turning students into market-ready professionals

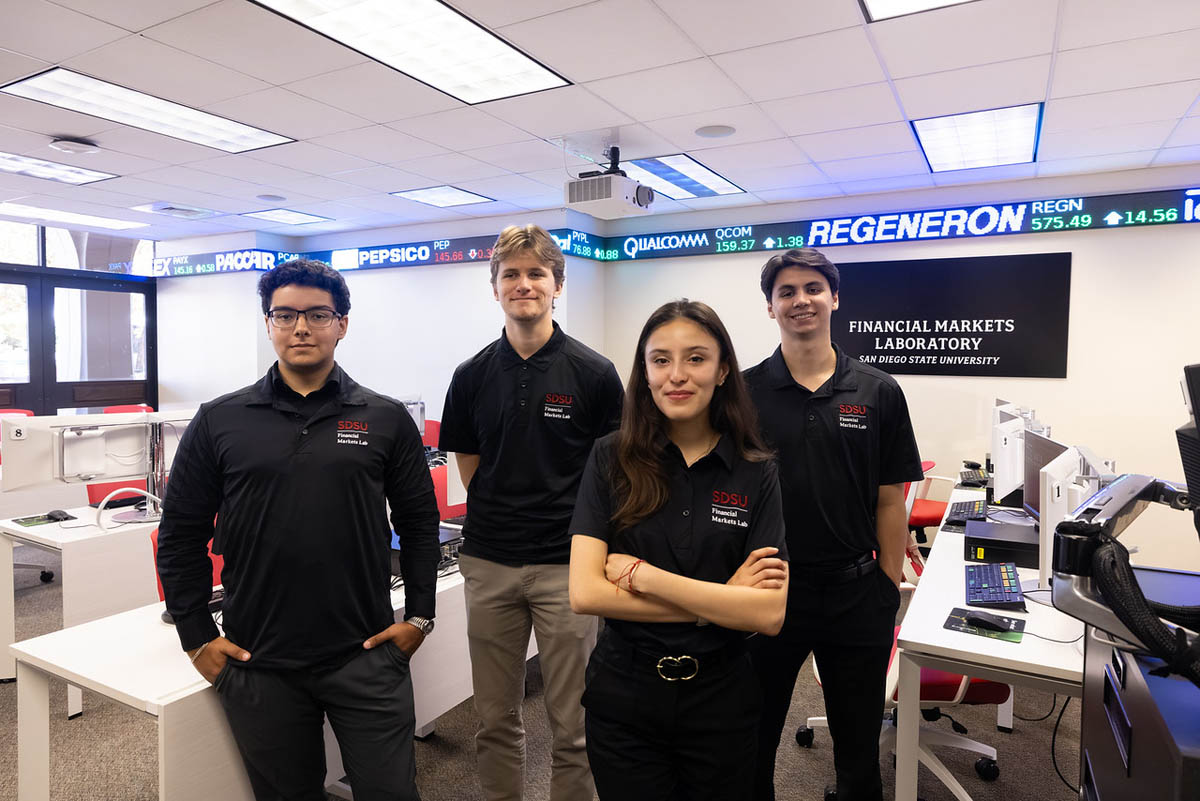

The Financial Markets Lab at SDSU’s Fowler College of Business has entered an exciting new chapter, revived and reenergized by new initiatives and expanded resources for students.

Originally established in 2012, the lab has transformed into a thriving hub where finance students gain real-world experience, connect with industry tools, and build networks that propel their careers forward.

Central to this revitalization is the lab’s enhanced use of Bloomberg Terminals, a state-of-the-art financial platform used by professionals worldwide to research, analyze and trade in global markets. With access to twelve terminals, Fowler students have the unique opportunity to work hands-on with the same technology used by Wall Street investment firms, right from the first floor of SDSU's University Library.

“The Financial Markets Lab is now much more than just a space,” said Jaemin Kim, chair of the finance department. “It’s become the place where students go to build skills, connect with peers who share their interest in finance, and prepare for what’s next.”

A Hub for Financial Research and Collaboration

As part of its revitalization, the lab now regularly hosts peer-led sessions to help students conduct research for class projects, case competitions and even independent studies.

Michael May, who graduated this spring with a degree in finance, helped introduce the Economic Research Challenge, an initiative inviting students to investigate how tariffs affect the broader economy and financial markets. His research, under the guidance of Kim and Fowler operations manager Edward Rey, uses Bloomberg data to explore the impact of tariffs on microchips, steel and other automotive components.

“I wanted to create a research project where students could participate with the goal of educating them on the use of the Bloomberg Terminals,” he said. “A secondary goal is to get the research published. It’s an ambitious goal, and I hope to have my first report completed by this fall.”

Open the image full screen.

Open the image full screen.

Preparing for the World Stage

The Financial Markets Lab has also become an essential resource for students participating in high-profile case competitions like the CFA Institute Research Challenge, where teams from around the world analyze publicly traded companies and pitch investment strategies to financial experts. Fowler’s 2025 team relied heavily on the lab’s tools and its peer advisors to sift through and analyze 10 years of data for a publicly traded company.

“The lab played a critical role in our preparation,” said finance professor Byeong-Je An, the team’s faculty advisor. “From downloading financial statements to reviewing earnings trends, the students used the lab’s resources to produce a highly detailed, professional presentation.”

To help students prepare for competitions like this, the lab also offers a Stock Pitch Program, led by recent finance graduate Brian Martinez. The program teaches students how to develop an investment thesis through equity research and provides skills that not only serve them in competition but also stand out on résumés. Martinez recently transitioned his summer internship at New York-based Stifel Financial Corporation into a full-time role as an investment banking analyst, demonstrating the significant impact these experiences can have.

New Challenges, Real Results

To build on this momentum, Martinez and May launched the Portfolio Trading Challenge, a semester-long competition where student teams manage virtual stock portfolios. The teams with the highest returns can win prizes and qualify for entry into the Bloomberg Global Trading Challenge in fall 2025.

Meanwhile, for students ready to go beyond virtual trading, the Aztec Investment Fund (AIF) will be available to undergraduates this fall. The AIF will offer students the opportunity to manage real investments in stocks, bonds, and commodities under the guidance of finance lecturer and investment professional Shane Thompson.

“The AIF will provide students a pathway to apply their classroom knowledge and obtain real results to heighten their learning experience and increase their competitive positioning in the career markets,” said Thompson. “It will also leverage benefits from the Financial Markets Lab and develop real-time market research skills and insights. This combination of resources is a significant step in enhancing the proposition for student success at SDSU and beyond.”